It’s easy to assume that insurance companies want to keep you from comparing prices. Drivers who rate shop once a year are likely to switch auto insurance companies because the odds are good of finding a more affordable policy. A recent survey found that consumers who compared rates once a year saved over $72 a month compared to those who never compared other company’s rates.

It’s easy to assume that insurance companies want to keep you from comparing prices. Drivers who rate shop once a year are likely to switch auto insurance companies because the odds are good of finding a more affordable policy. A recent survey found that consumers who compared rates once a year saved over $72 a month compared to those who never compared other company’s rates.

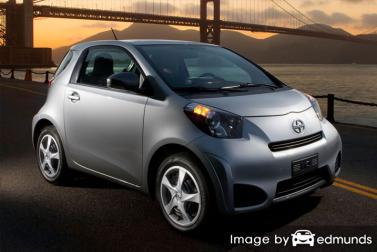

If saving the most money on Scion iQ insurance is the reason you’re here, then having an understanding of how to get price quotes and compare cheaper coverage can help you succeed in finding affordable rates.

It takes a few minutes, but the best way to find affordable quotes for car insurance rates is to compare quotes once a year from insurers who can sell car insurance in Lincoln. Prices can be compared by following these guidelines.

- Gain an understanding of what is in your policy and the modifications you can make to prevent high rates. Many things that cause high rates like getting speeding tickets and an unacceptable credit history can be controlled by being financially responsible and driving safely. Read the full article for additional ideas to find cheap prices and find possible discounts that are available.

- Quote rates from exclusive agents, independent agents, and direct providers. Direct and exclusive agents can only give rate quotes from a single company like GEICO or State Farm, while independent agencies can quote prices for a wide range of companies. Select a company

- Compare the quotes to your existing policy to determine if you can save on iQ insurance. If you find a lower rate quote, make sure coverage does not lapse between policies.

- Provide notification to your current agent or company of your intent to cancel your current auto insurance policy and submit a down payment along with a completed application to the new company. Once coverage is bound, store the certificate verifying proof of insurance above your visor, in the console, or in the glove compartment.

The critical component of shopping around is to make sure you enter the same coverage limits and deductibles on every price quote and and to get quotes from all possible companies. Doing this ensures an accurate price comparison and a good representation of prices.

Lower rates by qualifying for discounts

Auto insurance companies do not advertise every policy discount in an easy-to-find place, so we researched both the well known and the more hidden credits that you can use to lower your rates.

- Student Discount for Driver Training – Cut your cost by having your teen driver complete a driver education course in school or through a local driver safety program.

- Discount for Life Insurance – Not every insurance company offers life insurance, but if they do you may earn a discounted rate on car insurance if you buy life insurance.

- Good Student – Performing well in school can earn a discount of 20% or more. This discount can apply up until you turn 25.

- Accident Free – Claim-free drivers get the best auto insurance rates when compared with drivers who are more careless.

- College Student – College-age children who live away from home to go to college and do not have access to a covered vehicle may be able to be covered for less.

- Onboard Data Collection – Policyholders that allow driving data submission to study where and when they drive by using a telematic data system such as Allstate’s Drivewise and State Farm’s In-Drive system might get better premium rates if they are good drivers.

- Defensive Driving Course – Participating in a course in safe driver could save 5% or more if your company offers it.

- Renewal Discounts – A few auto insurance companies allow discounts for renewing your policy prior to your current iQ insurance policy expiration. This discount can save up to 10%.

- Full Payment Discount – By paying your policy upfront rather than paying monthly you may have a lower total premium amount.

- Low Mileage Discounts – Driving less could qualify for lower auto insurance rates on the low mileage vehicles.

It’s important to understand that most credits do not apply to your bottom line cost. Some only reduce the cost of specific coverages such as physical damage coverage or medical payments. So when it seems like you can get free auto insurance, it just doesn’t work that way.

Companies that may have most of the discounts above may include but are not limited to:

When getting a coverage quote, ask every company which discounts can lower your rates. A few discounts may not apply in your area. To locate auto insurance companies with the best discounts in Nebraska, click this link.

There are several ways of comparing rate quotes from different companies. The best way to compare rates is to perform an online rate comparison. Just keep in mind that comparing more prices helps you find lower pricing.

The companies in the list below are our best choices to provide free rate quotes in Nebraska. To buy cheap car insurance in NE, we recommend you get rates from several of them in order to find the most competitive rates.

Situations that may require an agent’s advice

Keep in mind that when it comes to choosing the right insurance coverage for your personal vehicles, there really is no cookie cutter policy. Everyone’s situation is unique and your car insurance should be unique as well.

These are some specific questions may help you determine whether your personal situation would benefit from an agent’s advice.

- Am I better off with higher deductibles on my Scion iQ?

- What is no-fault insurance?

- Am I covered when delivering products for my home-based business?

- Are my company tools covered if they get stolen?

- How can I get my company to pay me more for my totaled car?

- At what point should I drop full coverage?

- Is a new car covered when I drive it off the dealer lot?

- Does my insurance cover damage caused when ticketed for reckless driving?

If you don’t know the answers to these questions but one or more may apply to you, then you may want to think about talking to an insurance agent. To find an agent in your area, simply complete this short form or go to this page to view a list of companies.

Insurance agent or online?

Many drivers just prefer to sit down and talk to an agent and that is OK! One of the benefits of comparing insurance prices online is the fact that you can find cheap rate quotes and still choose a local agent.

Upon completion of this short form, your insurance coverage information is submitted to companies in Lincoln that can give you free Lincoln car insurance quotes and help you find cheaper coverage. There is no need to search for an agent because quoted prices will be sent to you. Get lower rates AND an agent nearby. If you need to get a rate quote from a particular provider, you would need to jump over to their website and fill out the quote form the provide.

Upon completion of this short form, your insurance coverage information is submitted to companies in Lincoln that can give you free Lincoln car insurance quotes and help you find cheaper coverage. There is no need to search for an agent because quoted prices will be sent to you. Get lower rates AND an agent nearby. If you need to get a rate quote from a particular provider, you would need to jump over to their website and fill out the quote form the provide.

Selecting an company requires more thought than just a cheap quote. Some important questions to ask are:

- Will the quote change when the policy is issued?

- Do they have any clout with companies to ensure a fair claim settlement?

- Can they provide you with a list of referrals?

- Is the agency involved in supporting local community causes?

- Do they carry Errors and Omissions coverage?

- Which members of your family are coverage by the policy?

- Does the company use OEM repair parts?

If you are wanting to find a reliable agent, it’s important to understand the different types of agencies and how they can service your needs differently. Agencies in Lincoln can be classified as either exclusive or independent (non-exclusive).

Exclusive Agencies

Agents that elect to be exclusive normally can only provide a single company’s rates and some examples include AAA, Allstate, State Farm, or Farmers Insurance. They usually cannot provide prices from multiple companies so it’s a take it or leave it situation. Exclusive agencies receive a lot of sales training on their products and sales techniques and that can be a competitive advantage. Consumers sometimes choose to use a exclusive agent mainly due to high brand loyalty instead of buying on price only.

Below are exclusive insurance agencies in Lincoln who can help you get price quotes.

- Paul Johnson – State Farm Insurance Agent

5533 S 27th St #204 – Lincoln, NE 68512 – (402) 420-2288 – View Map - Roger McGinnis – State Farm Insurance Agent

6900 O St #105 – Lincoln, NE 68510 – (402) 466-6300 – View Map - Allstate Insurance: Earnest and Associates, Inc

4221 O St – Lincoln, NE 68510 – (402) 488-0955 – View Map

Independent Agents (or Brokers)

Independent agents are not required to write business for one company so they can quote policies with many different companies enabling the ability to shop coverage around. If they quote lower rates, the business is moved internally which makes it simple for you. When comparing auto insurance prices, we highly recommend that you include several independent insurance agents in order to compare the most rates. Many can place coverage with smaller regional carriers which may provide better rates.

Listed below is a list of independent insurance agents in Lincoln that can give you comparison quotes.

- Solid Ground Insurance LLC

6000 South 58th Street Suite C – Lincoln, NE 68516 – (402) 420-7654 – View Map - Buethe and Associates Insurance Agency

2337 S 13th St – Lincoln, NE 68542 – (402) 474-2063 – View Map - MIAA – Midwest Insurance Agency Alliance

6120 Havelock Ave – Lincoln, NE 68507 – (402) 467-5355 – View Map

Once you have positive feedback to all your questions as well as cheap iQ insurance quotes, it’s a good possibility that you have found an insurance agency that meets your needs to service your policy.

Don’t give up on affordable rates

Affordable Scion iQ insurance in Lincoln can be bought both online and also from your neighborhood Lincoln agents, and you should compare rates from both to have the best rate selection. A few companies do not provide online price quotes and these small insurance companies only sell through independent insurance agents.

As you restructure your insurance plan, do not skimp on coverage in order to save money. There have been many situations where drivers have reduced liability limits or collision coverage and learned later that the savings was not a smart move. Your objective should be to buy a smart amount of coverage at the best price while still protecting your assets.

Throughout this article, we presented a lot of information how to save on Scion iQ insurance in Lincoln. The key thing to remember is the more rate quotes you have, the better your comparison will be. You may even find the best rates are with a smaller regional carrier. Some small companies may cover specific market segments cheaper as compared to the big name companies such as Progressive or GEICO.

Additional detailed information is available in the articles below:

- Prom Night Tips for Teen Drivers (State Farm)

- How Much is Lincoln Car Insurance for 19 Year Olds? (FAQ)

- Who Has Cheap Auto Insurance Rates for Immigrants in Lincoln? (FAQ)

- Who Has Affordable Lincoln Auto Insurance for a Jeep Wrangler? (FAQ)

- When is the Right Time to Switch Car Insurance Companies? (Allstate)

- Preventing Carjacking and Theft (Insurance Information Institute)